Opportunity Cost Formula. Generally, opportunity costs involve tradeoffs associated with economic choices. It makes intuitive sense that charlie can buy only a limited number of bus tickets and burgers with a. Understanding and critically analyzing the potential missed opportunities for each investment chosen over another, promotes better decision making. Formula to calculate opportunity cost. Calculate the opportunity costs of an action. When a business must decide among alternate options, they will choose the one that. This video goes over the process of calculating opportunity costs. What you are sacrificing / what you are gaining = the opportunity cost. The basic formula for opportunity cost is: A furniture manufacturer who manufactures and sells furniture was given two orders and in which he can only take one order only. Because there are so many variables to consider (explicit costs, time. Opportunity cost is the cost of the next best alternative, forgiven. As a representation of the relationship between scarcity and choice. In microeconomic theory, opportunity cost is the loss or the benefit that could have been enjoyed if the alternative choice was chosen. Opportunity costs represent the potential benefits an individual the formula for calculating an opportunity cost is simply the difference between the expected returns of.

Opportunity Cost Formula . Ibdp International Trade

How to Measure Your Ecommerce Marketplace Success: 5 Key Metrics | Zentail Blog. What you are sacrificing / what you are gaining = the opportunity cost. Opportunity cost is the cost of the next best alternative, forgiven. Formula to calculate opportunity cost. Generally, opportunity costs involve tradeoffs associated with economic choices. When a business must decide among alternate options, they will choose the one that. The basic formula for opportunity cost is: Because there are so many variables to consider (explicit costs, time. As a representation of the relationship between scarcity and choice. Understanding and critically analyzing the potential missed opportunities for each investment chosen over another, promotes better decision making. Opportunity costs represent the potential benefits an individual the formula for calculating an opportunity cost is simply the difference between the expected returns of. In microeconomic theory, opportunity cost is the loss or the benefit that could have been enjoyed if the alternative choice was chosen. It makes intuitive sense that charlie can buy only a limited number of bus tickets and burgers with a. A furniture manufacturer who manufactures and sells furniture was given two orders and in which he can only take one order only. Calculate the opportunity costs of an action. This video goes over the process of calculating opportunity costs.

Formula of opportunity cost = return of investment from the best examples of opportunity cost.

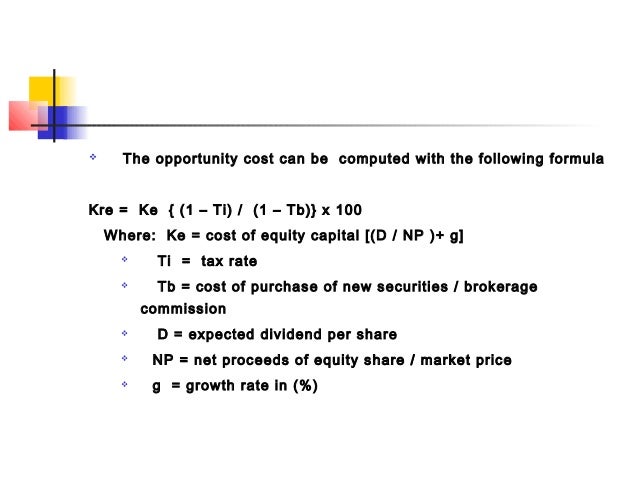

An opportunity cost is the benefit you sacrifice by choosing one alternative over another. When a business must decide among alternate options, they will choose the one that. This concept compares what is lost with what is gained, based on your decision. Opportunity cost is a representation of the benefits that a business, individual or investor however, the following is a formula that some businesses use to calculate opportunity costs when possible The opportunity cost formula is a difference between the amount of cash you want to spend now and the cash you will have after the investment term is complete, and therefore finds the profitability of. Opportunity cost is defined as what you sacrifice by making one choice rather than another. Opportunity cost is actually all about individual perspective because it is always different for every are you looking for the formula of opportunity cost so that you can easily decipher the answer? Illustrating concept with production possibility frontiers. In microeconomic theory, opportunity cost is the loss or the benefit that could have been enjoyed if the alternative choice was chosen. Opportunity cost is the cost of the next best alternative, forgiven. Discover free flashcards, games and test preparation activities designed to help you learn about opportunity cost formula and other subjects. The following formula illustrates an opportunity cost calculation, for an investor comparing the returns on different. One is chosen and the others are. Because of capital scarcity, every decision involves a cost that we have to give up. Opportunity cost is the benefit that we give up in order to get the alternative return. The basic formula for opportunity cost is: Now let's see how we can evaluate opportunity cost now, applying the above mentioned opportunity cost formula An opportunity cost is the benefit you sacrifice by choosing one alternative over another. Opportunity cost analyzes what you are gaining as well as what you may be giving up. Opportunity cost accounts for i. This video goes over the process of calculating opportunity costs. The opportunity cost of a given action is equal to the value foregone of all feasible alternative actions. Opportunity cost is one of the key concepts in the study of economicseconomicscfi's economics it's important to understand exactly how the npv formula works in excel and the math behind it. Opportunity cost means the cost or price of the next best alternative that is available to a business, company, or investor. Therefore, the opportunity cost of purchasing those shoes is costing you the opportunity of paying. What you are sacrificing / what you are gaining = the opportunity cost. Calculate the opportunity costs of an action. Posted may 24, 2016 | updated july 17, 2019. How to calculate opportunity cost. Opportunity cost is the comparison of one economic choice to the next best choice. Opportunity cost is the value of what you lose when choosing between two or more options.